- 07/02/2026

- 12:41 PM

- johan nagrub

As a CRE professional, you know how reporting overload and complex data can keep even the most seasoned market investors up at night. In 2026, the playing field has shifted. Market investors now face greater competition, expanding datasets, and more choices than ever before. This guide is designed to help market investors cut through the noise and navigate an evolving landscape with clarity. It outlines the latest trends, shifting investor profiles, technology adoption, risk management strategies, and regulatory developments shaping smarter decisions. Inside, you’ll find step-by-step frameworks, practical examples, and proven workflows to support the use of AI tools, dashboards, and predictive analytics. The goal is straightforward: position investors to outperform in a high-stakes, data-driven environment. Ready to future-proof your portfolio? Let’s turn complexity into opportunity.

The 2026 Market Landscape: Key Trends and Forces

Real estate data complexity is at an all-time high. Reporting overload, fragmented systems, and delayed insights create hurdles for CRE teams. As market investors, we now face a landscape where actionable data is the difference between outperforming or falling behind. Let’s break down what’s changing, why it matters, and how to stay ahead.

Mass Market Investor Expansion

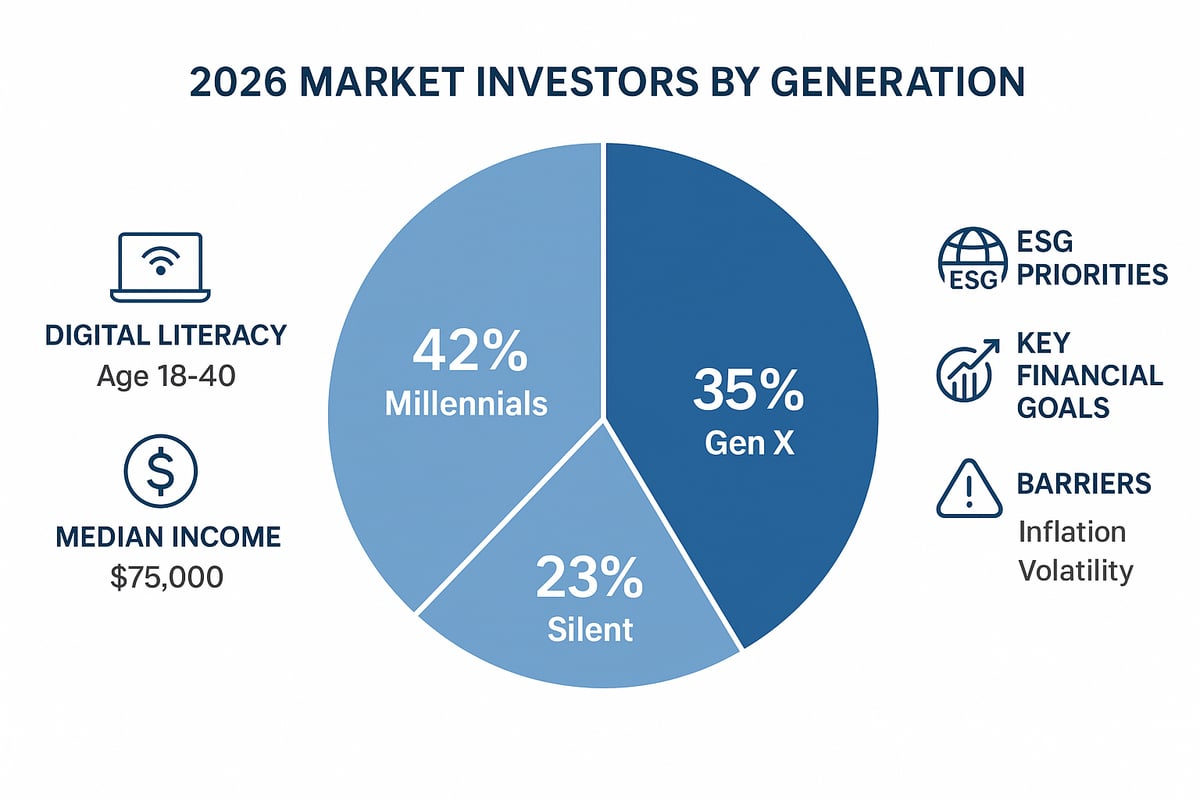

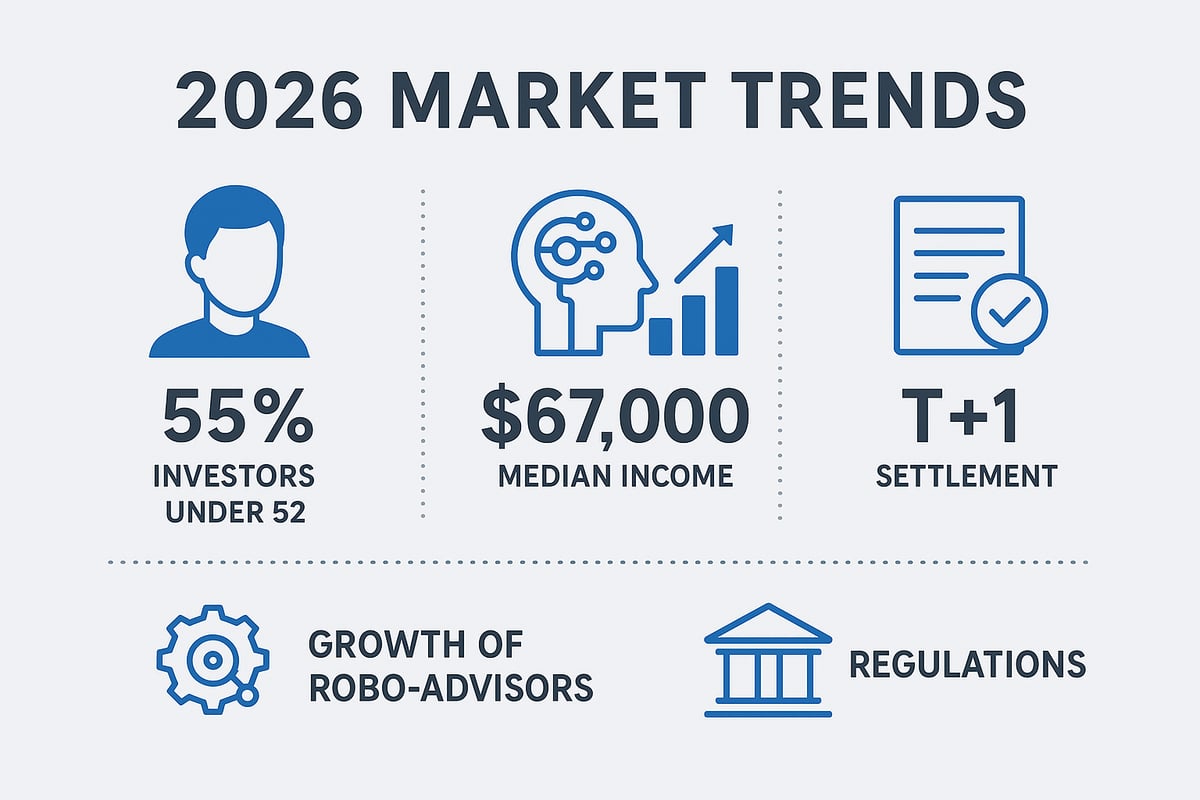

The profile of market investors is rapidly evolving. A surge in Millennial and Gen-X participation means 55 percent of investors are now under age 52. The median income sits at $67,000, which signals a broader investment base than ever before.

- Online trading apps and robo-advisors have lowered entry barriers.

- Democratization is real: more products and services now cater to lower wealth tiers.

- Digital literacy is essential as investors shift to self-directed strategies.

Industry leaders are analyzing tens of billions of datapoints to track how market investors behave. This level of insight allows us to tailor offerings, marketing, and onboarding workflows for a diverse, tech-savvy audience. Market investors today expect transparency, instant access, and digital experiences as the norm. To stay relevant, it’s critical that CRE professionals build digital-first touchpoints and leverage robust analytics.

Technology as a Market Disruptor

Technology has become the great equalizer for real estate investors. AI, automation, and advanced analytics are now foundational to investment decision-making. Robo-advisors and algorithmic trading platforms deliver low-cost, data-driven solutions at scale. Consider how real-time dashboards allow us to monitor portfolio performance, benchmark assets, and automate reporting. Mobile-first platforms have made investing frictionless, putting powerful tools in the hands of every market investor.

- Predictive analytics forecast rent growth, vacancy, and submarket momentum.

- Seamless app experiences drive engagement and retention.

- Automated alerts flag issues before they impact NOI or OpEx.

By adopting these tools, market investors can move faster, reduce error, and focus on high-value strategic work.

Regulatory and Economic Shifts

2026 brings a wave of regulatory changes aimed at transparency and investor protection. Shorter settlement cycles, like the EU’s T+1 target, require us to rethink operational workflows and data handoffs. Macroeconomic factors—rising inflation, interest rates, and supply chain volatility—add complexity to every investment decision. Firms that adapt quickly, using real-time compliance dashboards and scenario modeling, will outperform. For a comprehensive view of anticipated regulatory and economic trends, I recommend reviewing the 2026 Market Outlook by J.P. Morgan. It’s a key resource for market investors building resilient strategies. Staying agile, compliant, and data-driven is no longer optional. Now is the time to audit your workflows, integrate automation, and prepare for a market that rewards speed and transparency.

Profiling the 2026 Market Investor

Understanding today’s market investors starts with a challenge we all face: overwhelming amounts of data and increasingly complex reporting demands. The modern landscape is not just about numbers, it is about who is investing, how they behave, and what drives their decisions. Let’s break down the evolving profile of market investors in 2026 and see how you can turn these insights into action.

Demographics and Psychographics

Market investors in 2026 are more diverse than ever. Millennials now make up 60 percent of the segment, Gen-X represents 45 percent, and the Silent Generation still accounts for 15 percent. The median age sits at 52, showing strong engagement from both younger and older cohorts. This diversity means investment campaigns can no longer focus solely on younger audiences. Instead, successful outreach requires targeting all age groups with tailored messaging. Most market investors today are highly digital, comfortable researching trends, and quick to adopt new platforms. They expect data-driven insights, not just sales pitches. Here is a quick breakdown of the generational mix:

| Generation | Percentage of Market Investors |

|---|---|

| Millennials | 60% |

| Gen-X | 45% |

| Silent Generation | 15% |

Behavioral Shifts

The way market investors approach investing has shifted dramatically. Digital-first, self-service platforms are now the standard. Investors want personalized financial products, easy access to robo-advisors, and seamless digital experiences. There is a growing focus on environmental, social, and governance (ESG) investing. Real-time transparency, instant information, and customizable dashboards are non-negotiable. As highlighted in 2026 Investment Themes by Morgan Stanley, the adoption of AI and new technology is shaping how market investors evaluate opportunities and manage risk. Key behavioral trends:

- Preference for mobile and web-based platforms

- Demand for tailored advice and investment options

- Rising expectation for ESG-aligned choices

- Need for instant, transparent access to portfolio data

Financial Goals and Challenges

Market investors in 2026 are laser-focused on wealth accumulation, retirement planning, and building streams of passive income. However, they face real barriers including persistent inflation, economic uncertainty, and market volatility. To overcome these, investors are embracing strategies that balance growth with risk mitigation. Scenario planning, predictive analytics, and regular portfolio rebalancing are part of the new normal for market investors. The most successful are those who blend traditional wisdom with tech-enabled insights. Common goals and challenges include:

- Growing long-term wealth without overexposure to risk

- Securing reliable retirement income streams

- Navigating inflation and unpredictable markets

- Leveraging AI tools to flag risks and uncover new opportunities

Stay ahead by aligning your approach with these evolving priorities. Take stock of your own workflows, and consider how AI and data-driven dashboards can turn complexity into clarity.

Adopting Technology and Data-Driven Decision Making

In today’s CRE world, market investors face a constant barrage of data. Reporting overload, siloed systems, and inconsistent metrics make it tough to see the big picture, let alone act on it. If you’re feeling the pressure to do more with less, you’re not alone.

Leveraging AI and Advanced Analytics

AI is now the engine behind smarter investment decisions. For market investors, predictive analytics tools do the heavy lifting: they spot trends, benchmark assets, and flag risks in real time. Imagine logging into your dashboard and seeing projected rent growth, cap rate shifts, and submarket demand, all powered by machine learning. CRE pros use AI to analyze NOI, CapEx, and comps across portfolios, transforming raw numbers into clear action steps. To dive deeper into how predictive analytics reshapes decision-making for market investors, I recommend Predictive Analytics in Real Estate. Key tools and workflows:

- Automated anomaly detection for OpEx spikes.

- Scenario modeling for interest rate changes.

- KPI benchmarking against industry peers.

With these insights, market investors move from reactive to proactive, using data as a compass.

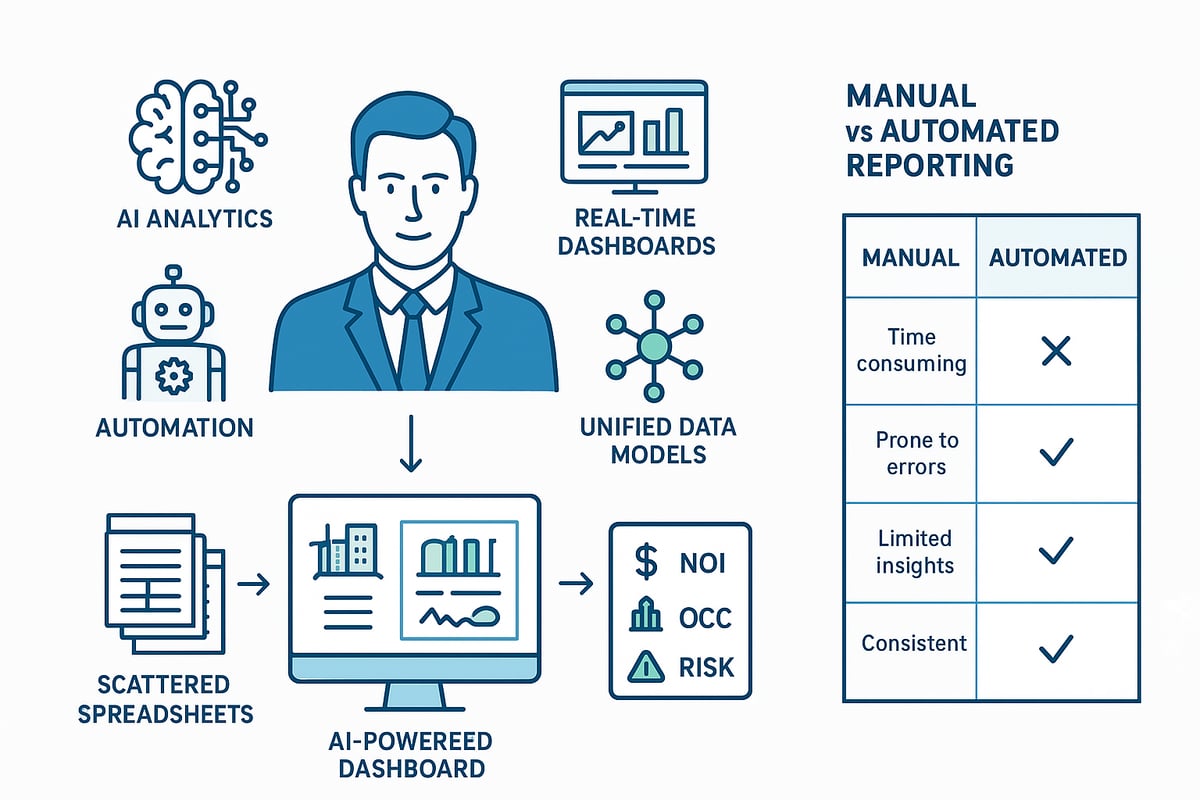

Streamlining Portfolio Management

Manual reporting drains time and energy. Automation lets market investors focus on strategy instead of spreadsheets. Centralized platforms now bring asset tracking, compliance, and benchmarking into a single view. Automated investment memos and pro-formas accelerate decision cycles for CRE teams. Here’s a sample dashboard table:

| Metric | Current Value | Target | Alert? |

|---|---|---|---|

| Occupancy Rate | 94% | 96% | ⚠️ |

| NOI Growth | 5.2% | 6% | |

| Expense Ratio | 31% | 28% | ⚠️ |

Key workflows to implement:

- Real-time cash flow forecasting.

- Automated compliance audits.

- Dynamic allocation adjustments based on market signals.

With the right setup, market investors can spot underperformers and act fast.

Overcoming Data Complexity

Disparate systems and delayed reporting stall progress. Market investors need unified data models and customizable dashboards to cut through the noise. Solutions include:

- Plug-and-play data integrations across Yardi, MRI, RealPage.

- Standardized reporting for apples-to-apples multifamily analysis.

- Instant onboarding for new assets or teams.

Here’s a simple workflow in code format:

# Automated data sync across platforms

for platform in ['Yardi', 'MRI', 'RealPage']:

sync_data(platform)

generate_dashboard('Portfolio Performance')

By harmonizing metrics, market investors finally get apples-to-apples comparisons and actionable insights, not just raw numbers. Quick onboarding and seamless integrations mean your team stays agile. Ready to unlock your next level? Start by mapping your current data pain points, then pilot one AI-driven workflow this quarter. The future belongs to market investors who let data and technology do the heavy lifting—so you can focus on strategy, not spreadsheets.

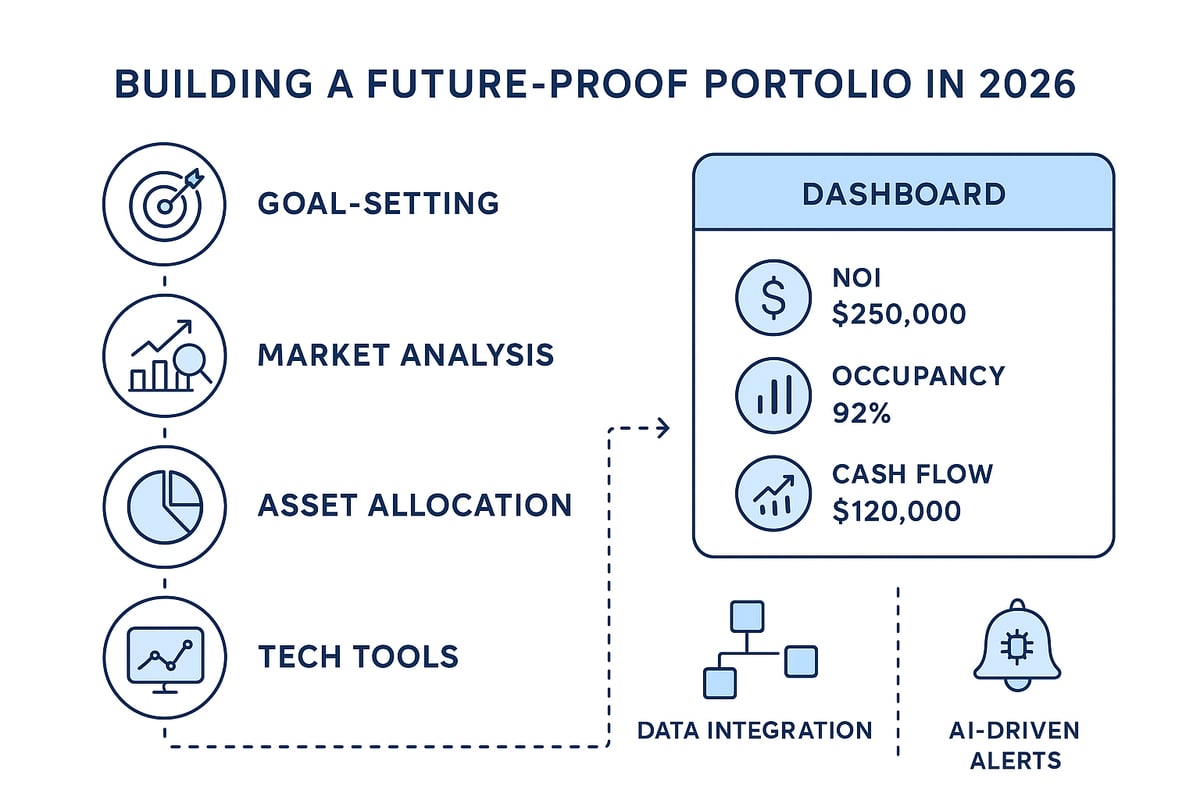

Step-by-Step Guide: Building a Future-Proof Portfolio in 2026

Facing reporting overload, data inconsistencies, and fast-changing markets, market investors need a clear, tech-driven approach to stay ahead. Let’s break down how to turn complexity into clarity—step by step.

Step 1: Define Investment Goals and Risk Appetite

Every successful journey for market investors begins with a clear destination. Start by clarifying your main objectives: Is your focus on capital growth, steady income, diversification, or capital preservation? Assess your risk tolerance honestly. Consider not just your personal comfort, but also macroeconomic headwinds like inflation and rate hikes. Scenario planning is vital—map out best, base, and worst-case outcomes for your portfolio.

- Use a table to compare risk profiles and likely asset mixes:

| Risk Profile | Strategy | Example Asset Types |

|---|---|---|

| Conservative | Capital preservation | Core multifamily, bonds |

| Balanced | Growth & income | Value-add CRE, REITs |

| Aggressive | High growth | Opportunistic CRE, tech funds |

Market investors who plan for volatility can better weather uncertainty.

Step 2: Analyze Market Opportunities

Market investors in 2026 must leverage AI-driven market research to spot emerging trends and submarkets. Start by tracking comps, absorption rates, and rent growth for both commercial and multifamily assets. Use location intelligence tools to identify neighborhoods or sectors showing sustained demand. Real-time dashboards can reveal occupancy shifts, tenant churn, or new supply risks.

- Key data points to monitor:

- Market comps (price per unit, cap rates)

- Rent growth trends

- Submarket vacancy rates

AI tools help market investors distill billions of data points into actionable intelligence, making acquisition decisions more precise.

Step 3: Optimize Asset Allocation

Diversification is the cornerstone for resilient market investors. Allocate across geographies, property types, and investment vehicles. Dynamic rebalancing, informed by predictive analytics, ensures your portfolio adapts to changing signals. Consider using Advanced Asset Portfolio Management strategies to streamline allocations and benchmark performance. Automated tools can suggest optimal mixes, flag concentration risk, and run stress tests.

- Example: Rebalance allocations if predictive models flag a downturn in office while multifamily outperforms.

- Key metrics: Portfolio occupancy, revenue growth, OpEx ratios

This approach helps market investors stay proactive, not reactive.

Step 4: Implement Technology Solutions

Embracing tech is non-negotiable for market investors aiming to scale. Integrate platforms that automate reporting, streamline asset tracking, and centralize performance data. Plug-and-play compatibility with property management systems (Yardi, MRI, RealPage) reduces manual input and errors. Custom dashboards aligned to your KPIs—NOI, cash flow, rent roll—bring clarity and speed to decision-making.

- Benefits:

- Faster onboarding and reporting

- Real-time alerts for underperformance

- Seamless compliance checks

Market investors who automate routine workflows gain time for higher-value analysis and strategy.

Step 5: Monitor, Benchmark, and Adjust

Continuous improvement is key for market investors. Schedule regular review cycles, using real-time dashboards and automated alerts to monitor asset health. Benchmark performance against internal targets and industry peers. Set up alerts for occupancy dips, expense spikes, or missed revenue goals. Use scenario analysis tools to test portfolio resilience under different market shocks.

- Example: An alert flags a sudden drop in NOI for one asset, prompting a quick lease audit.

- Table for review cadence:

| Frequency | Task |

|---|---|

| Monthly | KPI review, peer benchmarks |

| Quarterly | Portfolio rebalancing |

| Annually | Strategic planning |

By making data-driven adjustments, market investors can future-proof their portfolios for 2026 and beyond.

Navigating Regulatory, Risk, and Compliance Challenges

Staying ahead of regulatory, risk, and compliance challenges is mission-critical for market investors in 2026. The complexity of real estate data, reporting overload, and shifting regulations can feel overwhelming, but with the right workflows and tools, CRE professionals can transform compliance from a pain point into a competitive advantage.

Evolving Regulatory Landscape

In 2026, regulatory demands are evolving fast. We see new rules emphasizing transparency and stronger investor protection. One major shift is the EU’s T+1 settlement cycle, which requires market investors to adapt operational workflows for faster transaction clearing. Automated compliance monitoring is now a must-have. Real-time dashboards and instant alerts help teams stay ahead of deadlines and avoid costly errors. I recommend integrating compliance workflows with your portfolio management systems for seamless reporting. Understanding macroeconomic factors and regulatory trends is key. For a deeper dive into how these changes impact market investors and affect forecasts, check out the 2026 Housing Market Forecast.

Managing Market and Operational Risks

Market investors face more risk variables than ever: volatility, inflation, and global supply chain shocks. AI-driven tools are the “how” for smarter risk detection. Automated audit platforms can flag contract discrepancies, overbilling, and anomalies—reducing manual review time and catching issues early. Key metrics to monitor include revenue variance, OpEx spikes, and compliance exceptions. Set up real-time dashboards that trigger alerts for any out-of-range KPIs. This proactive approach empowers market investors to act before minor issues become major setbacks. Leading firms are adopting AI audit tools. To see how institutional investors leverage AI for compliance and research, explore AI’s Role in Investment Research.

Enhancing Resilience and Governance

Resilience is no longer optional. Market investors must build contingency plans for economic shocks, regulatory shifts, and operational disruptions. Real-time scenario analysis lets you stress test portfolios and visualize how changing market conditions impact NOI, cap rates, and risk exposure. Fostering a culture of risk awareness is key. Regular team training and transparent governance frameworks help teams adapt quickly. I recommend documenting response protocols and using dashboards to track readiness. The bottom line: Combine data-driven insights with agile workflows. This is how market investors stay compliant, resilient, and ahead of the curve.

Actionable Takeaways and Next Steps for Market Investors

Navigating 2026 as a CRE professional means facing a tidal wave of data, reporting overload, and evolving market dynamics. I see many market investors struggling to filter noise from signal. The good news? With the right frameworks, technology can turn complexity into clarity.

Key Lessons from 2026 Market Trends

The most successful market investors are those who embrace technology and data as force multipliers. Instead of drowning in spreadsheets, they deploy AI-driven dashboards to benchmark NOI, track OpEx, and flag market shifts instantly. Consider how predictive analytics now drive acquisition timing and asset allocation. As highlighted in AI Investment Trends in 2026, industry leaders leverage machine learning for smarter, faster decisions. This shift is not optional—it’s the new baseline.

- Use dashboards for real-time portfolio health

- Automate reporting to reduce manual errors

- Benchmark against industry peers for sharper insights

Building a Sustainable Investment Strategy

Sustainable success for market investors requires aligning goals with what’s next. That means integrating predictive analytics into every stage, from due diligence to ongoing management. I recommend regular training on emerging platforms and staying alert to regulatory updates. For those seeking the next big move, explore Top Real Estate Investment Opportunities 2026 to identify high-growth segments.

Key steps: 1. Prioritize Automation and Integration Connect property management, accounting, and analytics systems to create a single source of truth. Automation reduces manual errors, improves reporting speed, and supports scalable growth.

2. Strengthen Data Literacy Ensure teams can interpret dashboards, KPIs, and AI-driven forecasts. Practical training turns raw data into actionable portfolio decisions.

3. Monitor Macroeconomic Signals Track interest rates, inflation, and capital market conditions through structured review cycles. Timely adjustments help maintain resilience and protect performance.

Solution-Focused Recommendations and Call to Action

To future-proof your portfolio, market investors should:

- Standardize data for apples-to-apples comparisons

- Set up automated alerts for underperformance or compliance risks

- Continuously benchmark and optimize asset allocation

Engage with tech partners and CRE peers to exchange best practices. Start by scheduling a portfolio audit or demo with a leading analytics provider. By taking these steps now, you’ll be positioned to thrive, not just survive, in the evolving landscape. Positioning Market Investors for 2026 and Beyond Ready to put these 2026 strategies into action? AI-driven analytics, seamless reporting, and proactive risk management are already reshaping multifamily investing. For teams aiming to benchmark assets, optimize NOI, and reduce manual workload, the next step is clear. Leni’s analytics platform streamlines portfolio management by centralizing data, automating reporting, and delivering real-time insights tailored for CRE professionals. From benchmarking performance to uncovering hidden inefficiencies, Leni equips teams with the clarity needed to move decisively in a competitive market. Let’s dive in together:

Leni is an AI analyst with a background in real estate.

Born in 2022, Leni works alongside asset managers, asset owners, and limited partners, helping teams stay oriented across systems like Yardi and Entrata. With an understanding of both operations and financials, Leni helps teams spot risk early and actively steps in by surfacing insights, creating alerts, and keeping work moving, decisions aligned, and momentum intact.

-

Property Asset Managers Guide: Expert Insights for 2026

-

The Expert Guide to Multifamily Investors in 2026

-

Multifamily Real Estate Investing Guide for Success in 2026

-

Essential Guide for Market Investors in 2026

-

7 Essential Asset Management Real Estate Strategies for 2026

-

How Asset Management KPIs Drive Business Performance