- 09/02/2026

- 3:40 AM

- johan nagrub

Multifamily investing is entering a defining phase. As 2026 approaches, capital flows are tightening, renter demand is shifting, and performance gaps between average and top-tier operators are widening. What once worked as a steady strategy now requires sharper underwriting, smarter capital structures, and faster operational execution. Rental demand remains resilient, yet rising rates, regulatory pressure, and supply imbalances are reshaping deal dynamics. At the same time, data analytics and automation are transforming how portfolios are evaluated and managed. This guide outlines the market forces, investment frameworks, technology shifts, and risk controls shaping multifamily success in 2026, delivering practical direction for investors aiming to outperform in a more competitive landscape.

The 2026 Multifamily Investment Landscape

Multifamily investors in 2026 face a new landscape shaped by shifting demographics, capital flows, and regional market dynamics. Here’s what’s driving the change and how to navigate it.

Key Market Drivers

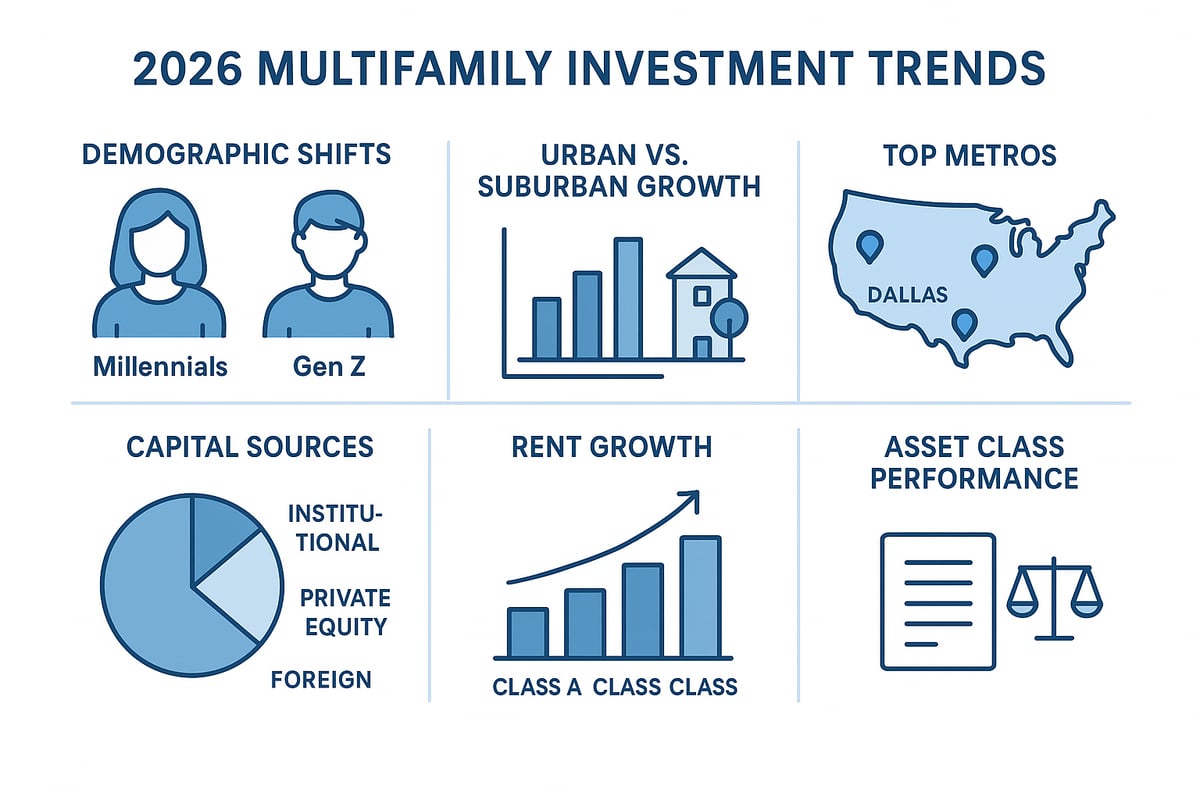

Multifamily investors in 2026 are contending with rapid demographic shifts. Millennials and Gen Z are driving sustained renter demand, while preferences swing between urban and suburban living. Economic factors like inflation, rising interest rates, and wage growth are impacting affordability and investment decisions. Supply remains tight due to construction bottlenecks and slow-moving zoning reform. Regulatory changes, including rent control expansions and ESG mandates, add layers of complexity for multifamily investors. For example, Sunbelt cities are outperforming national averages in rent growth (CoStar, 2023), and national vacancy rates are projected to stay below 5 percent through 2026 (NMHC).

Capital Flows and Investor Sentiment

Capital is pouring into the sector, with institutional funds, REITs, and global investors seeking stable returns. Multifamily investors are also seeing increased activity from private equity and syndication platforms. However, higher borrowing costs are tempering deal volume and making underwriting more rigorous. Blackstone’s $30B multifamily portfolio expansion highlights the scale of capital deployment. According to CBRE, 62 percent of investors plan to increase their multifamily allocations in 2026. This influx is reshaping competition and deal structures, requiring multifamily investors to refine their strategies for sourcing and structuring deals.

Regional and Asset Class Performance

Performance varies sharply by region and asset class. Here’s a quick comparison:

| Metro | Asset Class | Occupancy | Rent Growth (YoY) |

|---|---|---|---|

| Dallas | Class B | 96% | 7% |

| Phoenix | Class B | 95% | 8% |

| Atlanta | Class C | 94% | 6% |

| Charlotte | Class B | 95% | 7% |

Class B assets are outperforming Class A on occupancy (RealPage, 2024), while Sunbelt rent growth is double the national average (Yardi Matrix). Submarket trends like workforce housing, build-to-rent, and SFR portfolios are in focus for multifamily investors. For a deeper dive into these trends, see the Multifamily Investment Outlook 2026. Multifamily investors should tailor portfolios to these market realities, emphasizing asset class selection and geographic diversification.

Step-by-Step Guide: Building a Resilient Multifamily Portfolio in 2026

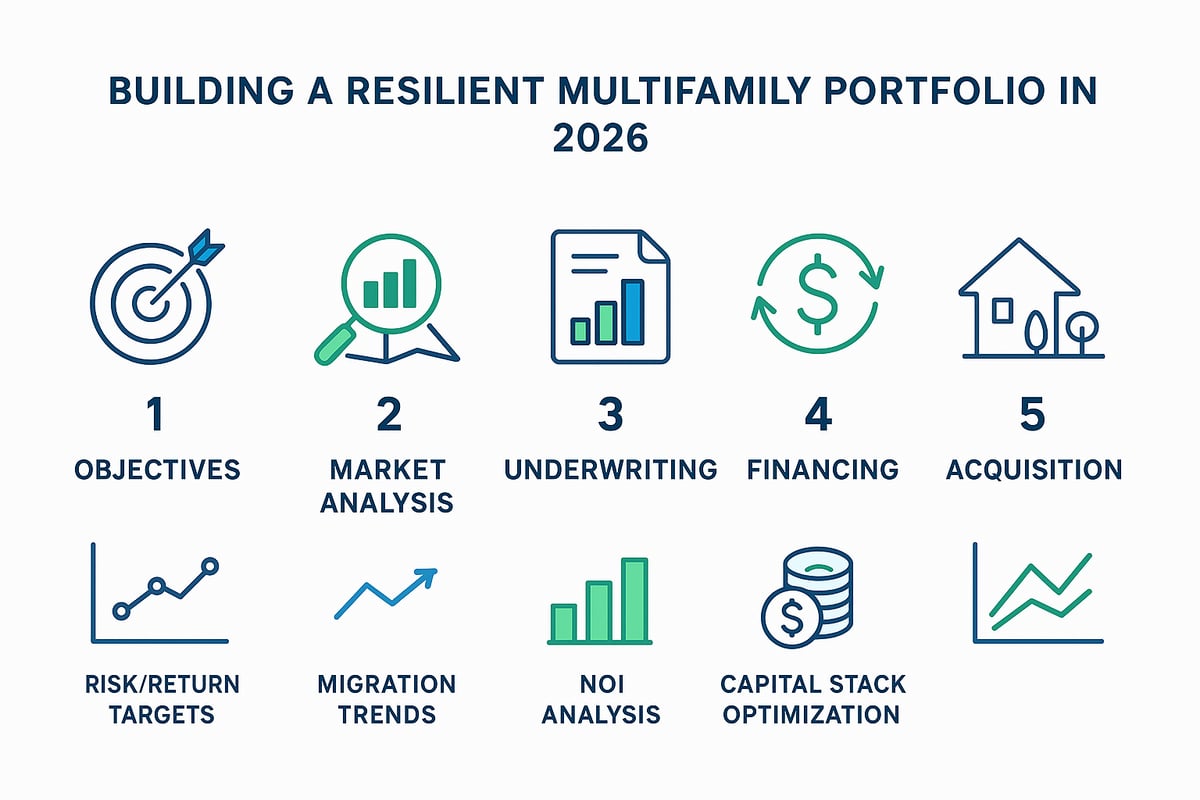

Building a resilient multifamily portfolio in 2026 means focusing on clear objectives, data-driven market selection, rigorous underwriting, smart capital structuring, and disciplined execution. Here’s my framework for multifamily investors seeking consistent outperformance.

Step 1: Defining Investment Objectives

Every journey for multifamily investors starts with clear objectives. Define risk tolerance—are you seeking stable cash flow, aggressive appreciation, or a mix? Set return targets, for example, IRR, cash-on-cash, or equity multiple. Decide on holding period (short-term flip versus long-term hold), and assess liquidity needs. Map these choices to your organization’s KPIs, like targeted NOI growth or portfolio diversification. A clear objective guides all future decisions, ensuring alignment for multifamily investors at every stage.

Step 2: Market and Submarket Selection

Multifamily investors must use data-driven location analysis to stay ahead. Evaluate job growth, migration patterns, and absorption rates for each target metro. Migration to the Southeast and Mountain West is accelerating, with metros like Atlanta and Denver seeing robust absorption. Compare submarkets using a table:

| Metric | Market A | Market B |

|---|---|---|

| Job Growth (%) | 2.8 | 1.7 |

| Absorption Rate | High | Medium |

Prioritize regions with strong fundamentals, but always validate against your investment thesis as multifamily investors.

Step 3: Asset Selection and Underwriting

Selecting the right asset is crucial for multifamily investors. Underwrite using detailed NOI forecasting and expense benchmarking. Conduct physical inspections and operational due diligence, checking for deferred maintenance and management gaps. Scenario modeling for rent growth and OpEx helps you stress-test returns. Interested in maximizing upside? Explore Multifamily value-add strategies that boost asset performance through renovations or operational enhancements.

Step 4: Financing and Capital Stack Optimization

Financing decisions for multifamily investors are evolving. In a rising rate environment, weigh debt versus equity carefully. Bridge loans can provide flexibility, while agency debt offers stability. Preferred equity can fill funding gaps, but watch for tightening debt service coverage ratios. Model your capital stack to ensure resilience if rates spike or values fluctuate. This approach keeps multifamily investors risk-aware and agile.

Step 5: Acquisition and Closing Best Practices

Acquisition discipline is where execution meets strategy. Streamline due diligence with organized workflows. Negotiate purchase agreements with clear contingencies for financing, inspection, and regulatory approvals. Plan for post-close transition, including onboarding property management and resident communications. A smooth handoff sets the tone for operational excellence and long-term portfolio health.

Technology & Data Analytics: The New Edge for Multifamily Investors

Tech adoption is the new edge for multifamily investors. Smart buildings, AI, and advanced analytics are transforming how portfolios are managed, benchmarked, and optimized.

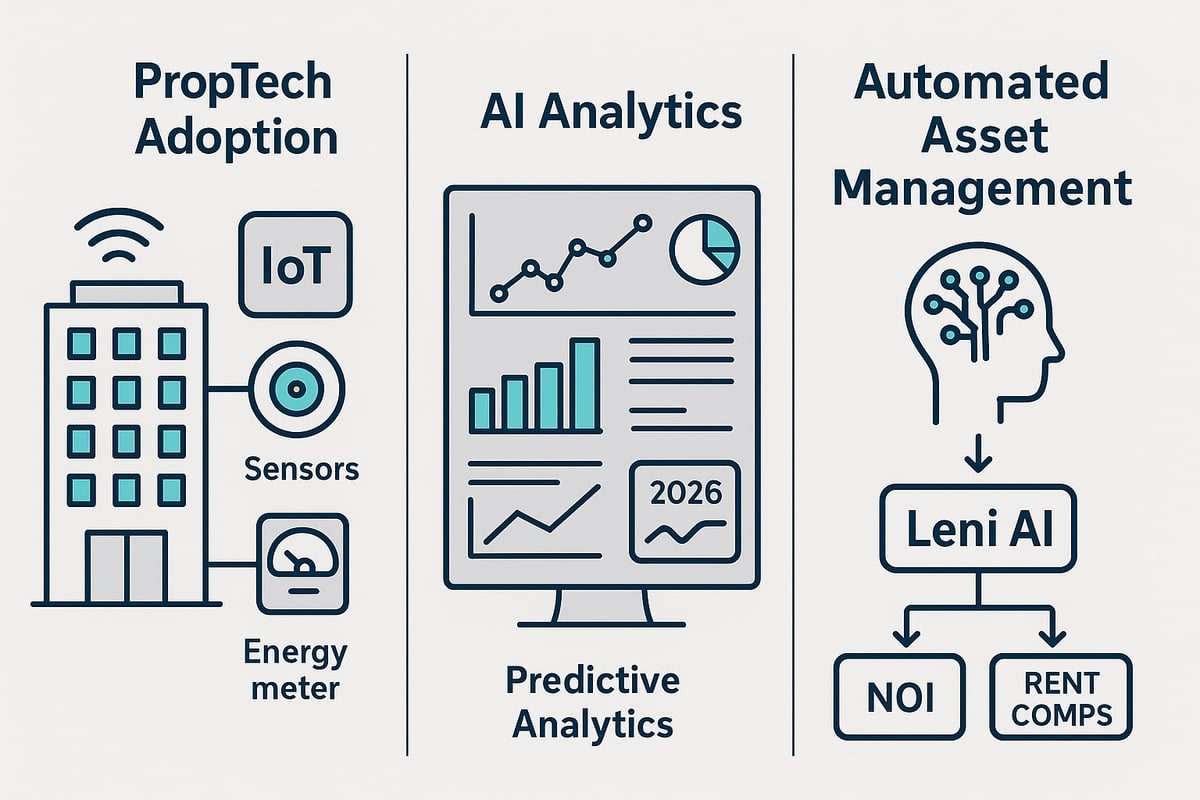

PropTech Adoption in 2026

Multifamily investors are seeing PropTech move from nice-to-have to essential. In 2026, smart building systems, IoT sensors, and integrated energy management tools are standard in new developments and retrofits. Automated leasing platforms now handle most resident communications, prospect screening, and even scheduling tours. What changed? The pandemic accelerated remote interaction, and residents now expect seamless digital experiences. Why does it matter? Operational savings, improved resident retention, and real-time visibility into OpEx are now critical for multifamily investors. Next step: Evaluate your current tech stack and identify gaps in automation, focusing on solutions with proven ROI.

Advanced Analytics and AI Tools

Predictive analytics and AI have become standard for multifamily investors seeking to optimize NOI and reduce risk. Today, platforms automate market rent comps, absorption forecasts, and portfolio benchmarking, providing data-driven insights in real time. For example, AI-driven asset management can improve NOI by up to 8 percent through smarter pricing and OpEx control. Automated reporting tools benchmark performance against local comps and flag emerging risks. To dive deeper, see this Data and AI in multifamily property management report for a breakdown of how analytics create competitive advantages for multifamily investors.

Analyst Notes: How Leni Transforms Multifamily Portfolio Management

Leni is an AI super agent purpose-built for real estate owners and operators. It automates asset benchmarking, reporting, and performance monitoring across multifamily portfolios, eliminating manual pro-forma updates and time-consuming variance analysis. By pulling real-time rent comps, lease data, and operational metrics, Leni surfaces risks, highlights trends, and delivers portfolio-level answers instantly. Designed to plug directly into platforms such as Yardi, Entrata, RealPage, and MRI, Leni works within existing workflows, no complex onboarding or IT lift required. Its AI analysts centralize data, generate predictive insights, audit recurring expenses, benchmark KPIs, and track market conditions in real time. As portfolio complexity increases, automation becomes a strategic advantage. With continuous data aggregation, detection, and forecasting, Leni enables multifamily teams to act faster, control OpEx, optimize NOI, and focus on higher-level strategy instead of spreadsheets.

Risk Management and Operational Excellence

For multifamily investors, the 2026 landscape brings both new risks and operational opportunities. Success means mastering compliance, optimizing OpEx, and embedding ESG into every investment decision.

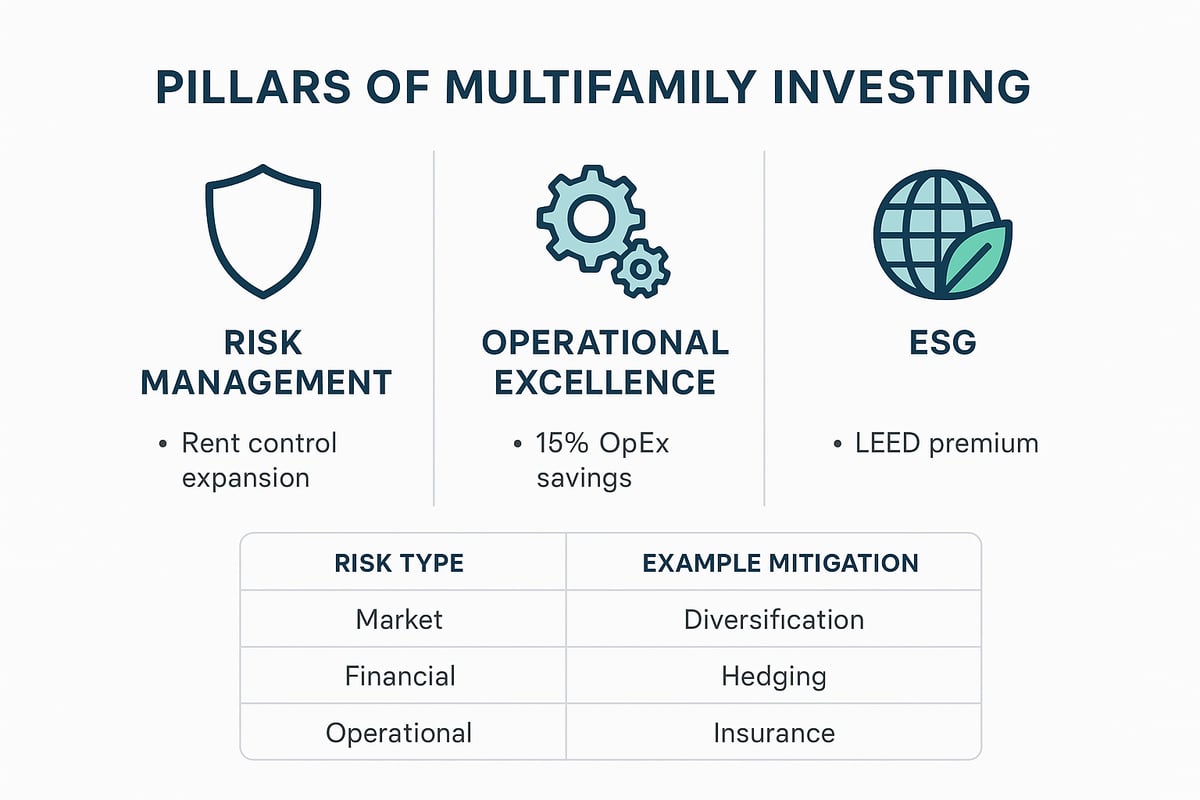

Identifying and Mitigating Key Risks

What changed: Regulatory risk is top of mind for multifamily investors in 2026. New rent control laws and ESG mandates are expanding in states like New York and California. Market risk, such as oversupply and absorption slowdowns, is rising in fast-growing metros. Financial risk is tied to interest rate spikes and cap rate compression. Why it matters: These risks can compress NOI, limit rent growth, or even stall deals. Multifamily investors must track policy trends, model downside scenarios, and adjust underwriting assumptions in real time. Next steps: Leverage technology for enhanced visibility and fraud prevention. For more on how AI and automation are transforming this space, read the Multifamily real estate AI revolution. Table:

| Risk Type | Example | Mitigation |

|---|---|---|

| Regulatory | Rent control expansion (NY, CA) | Proactive compliance review |

| Market | Sunbelt oversupply | Submarket absorption analysis |

| Financial | Rate spikes, cap rate compression | DSCR stress testing |

Operational Best Practices

What changed: Operational excellence is the new competitive edge for multifamily investors. Rising costs have put pressure on OpEx, while resident expectations for service have grown. Top operators now use benchmarking and automation to control expenses and improve retention. Why it matters: The difference between average and top-quartile operators is significant. According to IREM, leaders achieve OpEx savings of 15%. Best practices include:

- Expense benchmarking against peer assets

- Automated procurement and vendor management

- Resident engagement to reduce turnover

Next steps: Audit current workflows, benchmark OpEx by asset class, and automate repetitive processes. These practices help multifamily investors protect margins and reduce risk.

ESG and Sustainability Imperatives

What changed: ESG is now central to portfolio strategy for multifamily investors. Green certifications, energy efficiency, and social impact programs are not just nice-to-haves—they are increasingly required by investors and regulators. Why it matters: LEED-certified assets command rent premiums of up to 5% (CBRE, 2025). In 2026, 60% of investors require detailed ESG reporting (PwC). Sustainability practices also lower utility costs and attract residents. Next steps:

- Pursue green building certifications and retrofits

- Invest in energy and water conservation technology

- Develop affordable housing and wellness programs

| ESG Strategy | Impact | Example |

|---|---|---|

| LEED Certification | +5% rent premium | Urban mid-rise, Dallas |

| Water Conservation | Lower OpEx | Submetering, Phoenix |

| Social Initiatives | Higher retention | Resident wellness, Atlanta |

For multifamily investors, embedding ESG into operational playbooks is essential for long-term resilience—and for meeting the evolving demands of both residents and capital partners.

Future Outlook: Emerging Trends and Investor Strategies for 2026 and Beyond

The next era for multifamily investors is defined by shifting demographics, fast-changing capital markets, and smarter, tech-driven strategies. To thrive, multifamily investors need to harness data, diversify portfolios, and future-proof operations.

Demographic and Societal Shifts

What changed? The US population is aging, remote work continues to influence where people live, and immigration policies remain in flux. Why it matters: These trends shape demand for rental housing. Senior housing is gaining relevance as more Americans enter retirement age. Meanwhile, remote work has prompted a rise in hybrid households seeking larger units or suburban locations. Immigration and new household formation both fuel ongoing rental demand. What to do next: Multifamily investors should monitor these shifts closely. Targeting senior-friendly amenities, flexible floor plans, and markets with positive migration can help capture future demand.

Capital Markets and New Investment Vehicles

Capital flows are evolving. Crowdfunding, tokenization, and fractional ownership have opened new avenues for multifamily investors. Private REITs and open-ended funds are also expanding, offering greater liquidity and access.

| Vehicle | Liquidity | Minimum Investment | Regulatory Oversight |

|---|---|---|---|

| Crowdfunding | Medium | Low | Varies |

| Tokenization | High | Very Low | Emerging |

| Private REITs | Medium | Medium | High |

| Open-Ended Fund | High | High | High |

Why it matters: More options mean greater flexibility, but also new risks and diligence requirements. Crowdfunded multifamily deals are up 40 percent year-over-year, reflecting strong interest from both retail and institutional capital. What to do next: Understand the pros and cons of each vehicle. For a deeper dive into economic drivers and market context, see the 2026 housing market forecast.

Strategic Playbook for Forward-Looking Investors

What changed? Technology and analytics are now at the core of successful portfolio strategy. Data-driven decision making enables smarter market selection, risk management, and operational efficiency. Why it matters: Multifamily investors who diversify across regions and asset classes can better withstand local market volatility. Building resilient teams and partnerships is critical as regulations and standards evolve. What to do next:

- Invest in advanced analytics to benchmark performance and spot risk early.

- Use AI tools for predictive maintenance and automated leasing workflows.

- Diversify portfolios by market, asset class, and investment vehicle.

- Prioritize ESG and sustainability metrics to meet evolving investor requirements.

Operators leveraging AI for predictive maintenance and leasing are setting new benchmarks for NOI and OpEx performance. For a closer look at emerging AI technologies, explore AI Trends in Multifamily Housing. Actionable insight: Future-proof your multifamily portfolio by staying agile, data-focused, and ready to adapt as the landscape evolves. As we’ve explored, multifamily investing in 2026 is all about embracing data, adapting to shifting renter demand, and using smarter tools to drive NOI and asset value. You don’t have to figure it out alone. If you’re ready to see how AI-powered analytics and automated reporting can sharpen your portfolio strategy—benchmarking assets, optimizing OpEx, and surfacing actionable insights tailored to your KPIs—give Leni a try. See firsthand how the right tech can future proof your investments and help you outperform in a changing market.

Leni is an AI analyst with a background in real estate.

Born in 2022, Leni works alongside asset managers, asset owners, and limited partners, helping teams stay oriented across systems like Yardi and Entrata. With an understanding of both operations and financials, Leni helps teams spot risk early and actively steps in by surfacing insights, creating alerts, and keeping work moving, decisions aligned, and momentum intact.

-

Property Asset Managers Guide: Expert Insights for 2026

-

The Expert Guide to Multifamily Investors in 2026

-

Multifamily Real Estate Investing Guide for Success in 2026

-

Essential Guide for Market Investors in 2026

-

7 Essential Asset Management Real Estate Strategies for 2026

-

How Asset Management KPIs Drive Business Performance